Key Takeaways:

- Transitioning from manual paperwork to digital solutions has significantly enhanced payroll management efficacy.

- Emerging technologies like AI, blockchain, and cloud computing are transforming payroll systems.

- Globalization demands sophisticated payroll solutions that handle diverse international legal requirements and cultural nuances.

- An increase in self-service payroll platforms reflects the changing dynamic between employees and payroll departments.

- Future trends suggest a continuous evolution in payroll systems to improve accuracy, user accessibility, and legislative compliance.

Table of Contents:

- Introduction

- The Origins of Payroll Systems

- The Digital Revolution in Payroll Management

- Comprehensive Payroll Solutions for Modern Businesses

- Payroll Management’s Role in Regulatory Compliance

- Innovations Reshaping Payroll Management

- Security Concerns in Payroll Processing

- The Globalization of Payroll Systems

- Employee Self-Service Platforms

- Preparing for the Future of Payroll Management

Introduction

Payroll management is critical to business operations, directly affecting employee satisfaction and legal compliance. It reflects the progression of industrialization, showcasing a pivot from manual to automated and, now, digital processes. With the integration of various advanced software solutions, businesses in Canada and beyond must ensure their payroll practices evolve to keep pace with the needs of modern workforces and regulations. This article will unfold the story of this evolution and provide a forecasting glance at the future of payroll in Canada.

The Origins of Payroll Systems

In the old days, payroll in Canada was a straightforward yet painstakingly manual process involving ledger books and long hours calculating each employee’s wages. Modern systems are galaxies apart from the initial abacus and paper systems, transitioning towards sophisticated software. This metamorphosis provides seamless integration of diverse functions such as time tracking and tax calculation, demonstrating a significant leap from the days of manual ledger entries. An exploration of this historical journey aids in appreciating the current capabilities and in forecasting the trajectory of payroll services.

The Digital Revolution in Payroll Management

The infiltration of technology in the payroll sector has been nothing short of transformative. Digital systems have replaced the cumbersome, error-prone manual processes, enhancing accuracy and efficiency. This shift has allowed payroll departments to redirect focus from monotonous data entry to strategic financial management. Moreover, the digital revolution has democratized payroll systems, making sophisticated payroll management tools accessible even for small businesses that previously relied on rudimentary methods.

Comprehensive Payroll Solutions for Modern Businesses

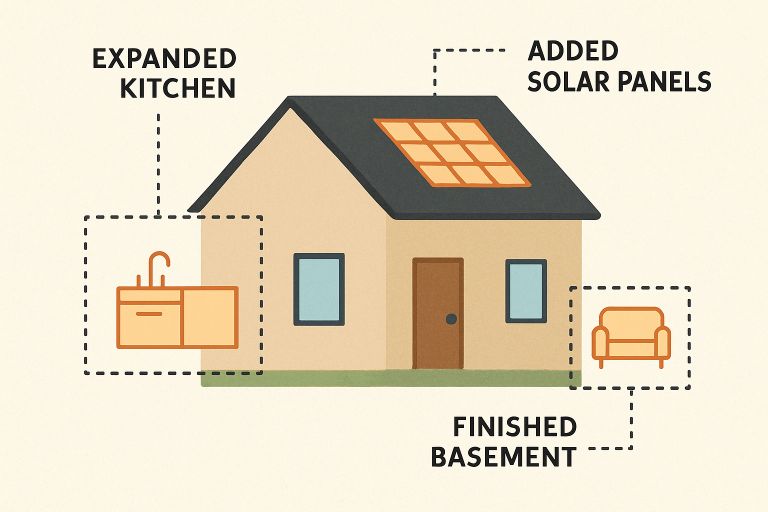

The complexity of current business operations demands comprehensive payroll solutions that can manage intricate calculations and diverse datasets. Enterprises today seek all-encompassing software that encapsulates withholding tax, benefit distributions, and various deductions in a singular, efficient tool. The advance in payroll systems reflects a robust backbone that can adjust in real-time to legislative changes, a non-negotiable requirement in a dynamic economic landscape. This integrated functionality underscores the technology-driven transformation payroll has undergone.

Payroll Management’s Role in Regulatory Compliance

As a critical nexus between business operations and regulatory frameworks, payroll management is often the first point of reference for compliance with employment laws. With the intricacies of tax codes and labor laws, a payroll system must exemplify impeccable accuracy and adherence to legal standards. These systems help businesses navigate the intricate legalities that vary by jurisdiction, ensuring compliance and averting potential penalties that could arise from errors or oversight. Hence, understanding and implementing robust payroll protocols is vital in maintaining business integrity and financial health.

Innovations Reshaping Payroll Management

With technology continually advancing, payroll systems are at the forefront of adopting innovations like AI to automate complex tasks and blockchain for immutable record-keeping. Cloud-based payroll solutions offer greater flexibility and scalability, while AI algorithms promise a new level of predictive analytics and decision-making assistance.

Security Concerns in Payroll Processing

Data breaches are a looming threat in the digital era, and payroll data ripe with personal and financial information is a particularly tempting target for cybercriminals. Protecting this data is paramount, not only to safeguard employees’ privacy but also to comply with stringent data protection laws. Businesses are thus compelled to fortify their payroll systems with advanced security protocols, encryption, and multi-factor authentication to ensure the sanctity of their data remains uncompromised.

The Globalization of Payroll Systems

As businesses extend their reach across borders, payroll systems must adapt to operate within a global framework, contending with various tax systems, currencies, and languages. Multinational companies face the arduous task of unifying their payroll operations across diverse geographical landscapes each with its unique regulatory environment.

Employee Self-Service Platforms

Employees today expect transparency and convenience in accessing payroll-related information. Self-service platforms empower them to manage their details, view pay stubs, and file for leaves independently. This hands-on approach fosters an environment of autonomy and trust, reducing administrative overload for payroll departments. By integrating such platforms, businesses enhance employee engagement while streamlining payroll operations.

Preparing for the Future of Payroll Management

The evolution of payroll is perpetual, with future trends leaning towards more comprehensive analytics, real-time reporting, and a user-centric approach. Advances in legislation and shifting workforce expectations anticipate continued changes to the payroll landscape. Organizations that embrace these changes by investing in scalable, flexible payroll systems will position themselves advantageously for the evolving dynamics of the global economy and the future of work.